Can Tax Tech make complex bureaucracy user-friendly for individuals and authorities alike?

Can Tax Tech make complex bureaucracy user-friendly for individuals and authorities alike?

“The significant increase in e-commerce, the developing crypto sector, new developing economies such as the gig economy and the creator economy, all of these create complex tax issues for individuals and small businesses,” noted Noga Lakritz, Director of Business Research at Team8

In the current era of hybrid work structures and constantly changing globalization themes and regulatory frameworks, individuals, and organizations alike, face new taxation challenges, causing the tax authorities to play catch-up with these ongoing developments.

This is precisely where the hottest fintech sphere – Tax Tech comes into play. Tax Tech is all about technology in the service of individuals and organizations. In a conference hosted earlier this month by the law firm Amit, Pollak, Matalon & Co., together with accounting firm Deloitte and Team8, various ways to adopt tax related technologies and the different challenges presented by social and economic drivers were discussed, as well as their interplay with the tax authorities.

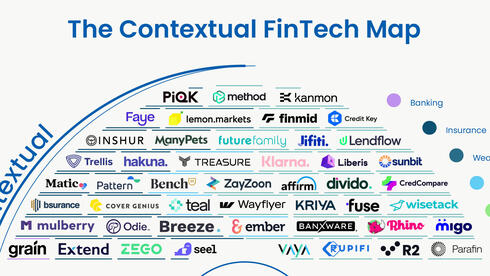

“Over the years, Israel has become a global and most significant hub in the fintech realm, integrating between technology and finance,” said Adv. Yoav Etzyon, managing partner and head of APM’s hi-tech practice. According to Etzyon, “a significant portion of investments in the industry in 2021, went into the fintech sector, which introduced considerable changes concerning general financial conduct by businesses, corporations and individuals.” Following this progress, “the practice of taxation has become more complex with new work structures being put-in-place, such as the gig economy, hybrid work practices and additional novel work structures catching-up, causing the tax regulation to follow suit. In the face of these challenges, the hottest fintech industry sphere introduces the technology that will transform complex bureaucracy into accessible and user-friendly solutions for individuals and authorities alike.”

CPA Yonatan Stark, International Taxation Director at Deloitte, addressed the changes of recent years in the world of tax, saying “if in the past an accountant would do all the work, nowadays, almost every corporation has a complex international structure creating regulatory challenges, and making it difficult to manage the financial operations. Technology can reduce risks, which is why we must understand it, and leverage it to make financial management more efficient.” As for the attitude of the tax authority towards new tax technologies, Stark said, “the tax authority is willing, but it is lagging years behind the business sector and market, which is the reason why, on the one hand, we are seeing individuals shying away from new technology, as they do not know how to report their transactions and, on the other hand, we are seeing the younger generation making investments but not reporting them. The authority remains silent, and the Bank of Israel has instructed banks to do as they deem fit. The bottom line is, in my opinion, there is an exceptional opportunity for the tax authority, who desires to promote innovation, to introduce tax tech solutions into the tax reporting systems, thus catching the entire public in an orderly fashion.”

Adv. (CPA) Racheli Guz-Lavi, managing partner and partner in APM’s tax practice noted “that hybrid work, in the scope of which people hold several positions, or combine working in Israel and abroad, has created a tax complexity – for both, the employee and the employer, which only serves to increase the need for tax tech systems that will address and solve these problems.” According to Guz-Lavi, “the interest in simplifying the system should first and foremost come from the State. For example, in the U.S., there is an application aiding persons forming part of the gig economy, to report their income to the tax authority, where in Israel, there is no similar solution.”

Adv. (CPA) Noga Lakritz, Director of Business Research at Team8 spoke about the impact of recent global changes, the way they create complex issues and the areas where we witness innovation. According to Lakritz “the significant increase in e-commerce, the developing crypto sector which is gravitating towards the realms of NFTs and DeFi, new developing economies such as the gig economy and the creator economy, all of these create complex tax issues for individuals and small businesses. An Israeli e-commerce trader that produces in China and sells in the U.S. and Europe, will encounter complex issues of customs, value added tax and sales tax, which he or she must manage with limited resources. Instead of focusing on the production, marketing, and sales, his or her attention is shifted away from the core business. In these worlds and in the realms of crypto, we are seeing a great deal of innovation, be it from fintech companies and platforms or from tax tech companies.”