IL Tech in NY“We look at investments as a two-way street,” says Amex Ventures

IL Tech in NY

“We look at investments as a two-way street,” says Amex Ventures

In collaboration with Israeli Mapped in NY, Amex Ventures has joined CTech for its IL Tech in NY series

“For a startup, working with a CVC provides more than just capital investment,” said Margaret Lim, Managing Director at Amex Ventures. “CVCs are the investment arms of large established organizations – and that has its unique value. For example, Amex Ventures brings the startups we invest in into our internal ecosystem and connects them with various teams across our business to explore partnerships and growth opportunities with our customers.”

Amex Ventures is a corporate venture capital fund founded in 2011 to help American Express’ core capabilities and accelerate efforts in consumer commerce and B2B services. According to Lim, the CVC can invest in companies whose technologies can augment and enhance Amex’s existing capabilities, or companies that can help deliver new benefits and features to its customers.

“We look at investments as a two-way street,” she continued. “We have the capital that a startup needs, but we also have a customer base that we are always looking for new ways to serve.”

You can read the entire exchange below:

Name and type of organization:

Amex Ventures, Corporate Venture Capital (CVC)

Main fields of investment:

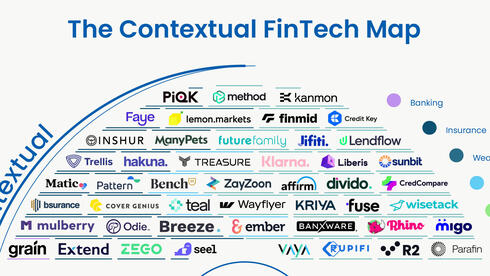

Consumer and B2B Services, Enterprise Capabilities, and Web3

Names of principals/managing partners:

- Matt Sueoka, Senior Vice President

- Margaret Lim, Managing Director

- Kevin Tsang, Managing Director

Year of founding/start of NY operations: 2011

Total sum of investments/size, number of funds:

Since the launch of American Express Ventures in 2011, the team has made more than 90 investments in startups focused on consumer and B2B services, enterprise capabilities and most recently Web3. We don’t disclose the financial terms of our investments, however we look to invest in early to growth-stage companies ranging from seed to Series C.

Number/size of rounds led:

We do not disclose the number of rounds we lead.

General background:

American Express Ventures was formed in 2011 to invest in innovative startups to enhance American Express’ core capabilities and accelerate efforts in consumer commerce and B2B services. Since then, we have expanded our focus to also include Web3. I joined Amex Ventures in 2019 as an Investment Director and have since been promoted to Managing Director. I focus on investments in consumer and B2B fintech companies, as well as those specializing in Web3. I am also responsible for forging partnerships between our portfolio companies and Amex business units such as Global Commercial Services, Consumer Banking and more. In the area of Web3, I’m driving use cases across Amex. To date, I have led investments in high-profile Amex Ventures portfolio companies including OneOf, Finmark, Firework, FalconX, Trellis, and TRM Labs, among others.

Company’s vision:

Our vision is to provide the world’s best customer experience every day. Our team’s mission is to help enable that by investing in companies that can help American Express advance its business. This can mean investing in companies whose technologies can augment and enhance Amex’s existing capabilities, as we’ve done in the security space, or it can mean investing in companies that can help us deliver new benefits and features to our customers like we’ve done in the business spend management space.

Ultimately, the framework and criteria we use to evaluate opportunities don’t change and will help guide us through the current economic landscape. We know that investing in new products and technologies is key to staying ahead. We believe partnering with startups is one way to do that. In fact, 70% of investments that have been in the Amex Ventures portfolio for over 36 months have a commercial relationship with American Express.

What types of Israeli startups/entrepreneurs are you interested in?

The startup community is vibrant in Israel, with many entrepreneurs building and innovating in areas that are key to American Express: Essential enterprise technologies (cybersecurity and fraud detection, AI & automation), as well as consumer and B2B commerce. Our activity in the region has really increased over the past few years, and we are attracted to the growing fintech sector. We have invested in many Israeli companies including Melio, BioCatch, EverC (EverCompliant), and Mirato, among others that have since been acquired.

Why invest in an Israeli company in New York? What advantages do such companies have? How is the New York market different from the Israeli market?

As I mentioned earlier, the startup community is full of opportunity in Israel, and Tel Aviv specifically is becoming known on the world’s stage as a hub of innovation. Israel hosts excellent engineering and product development, as well as a top-tier talent pool that brings a diversity of innovation and thinking to the startup ecosystem. We’re especially interested in Israeli startups that are breaking new ground in areas that are strategic to our core focus like fintech, cybersecurity, and more recently Web3.

How do Israeli entrepreneurs/startups compare to their local counterparts?

Most founders of startups possess the same traits, regardless of location. Traits like the ability to imagine a world wholly different from the one we live in and then make that world a reality. There is also a considerable need for grit and perseverance to take an idea and bring it to life through numerous funding rounds, building a trusted team, and growing an idea at scale.

What are some benefits of Israeli startups working with CVCs?

For a startup, working with a CVC provides more than just capital investment. CVCs are the investment arms of large established organizations – and that has its unique value. For example, Amex Ventures brings the startups we invest in into our internal ecosystem and connects them with various teams across our business to explore partnerships and growth opportunities with our customers. We look at investments as a two-way street. We have the capital that a startup needs, but we also have a customer base that we are always looking for new ways to serve.

The IL Tech in NY project is a collaboration between CTech and Israeli Mapped in NY. For more information email Guy Franklin via this link.