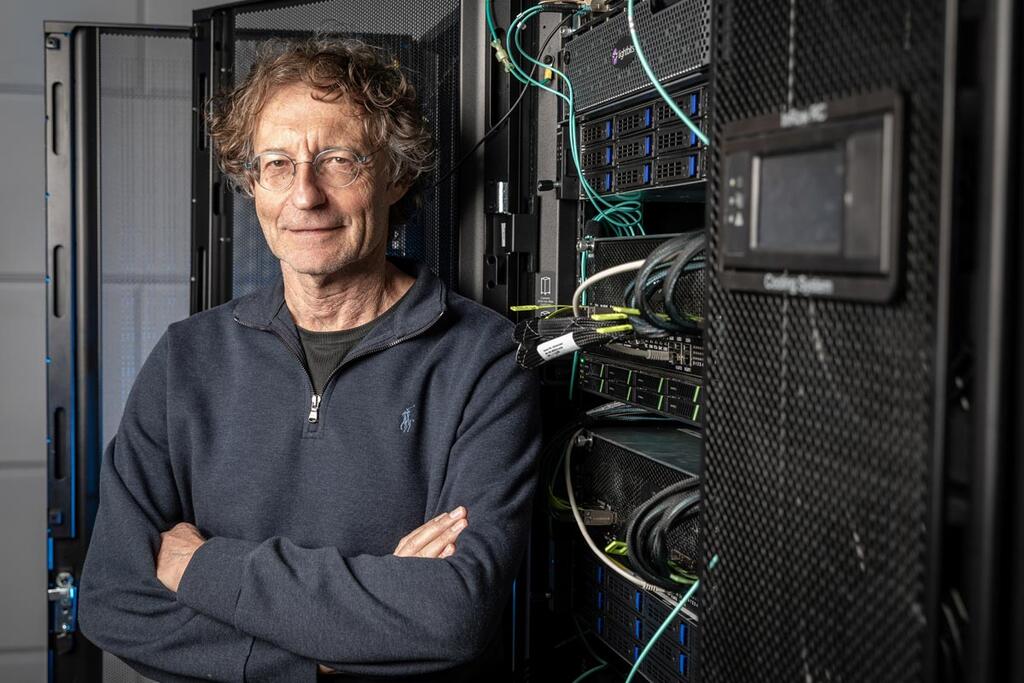

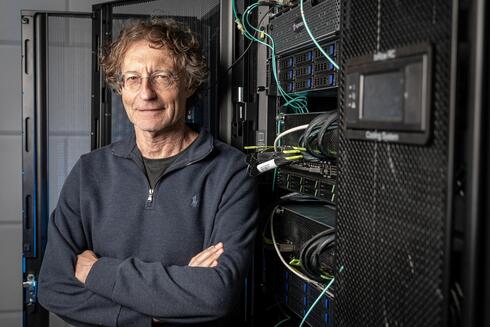

Legendary Israeli investor strikes gold again with Astera Labs

Chip company Astera Labs, in which Israeli entrepreneur Avigdor Willenz is a founding investor, has surged since its IPO last week. This exit joins Willenz's string of successes in the world of chips, which began with the sale of Galileo to American company Marvell for $2.7 billion in 2000 and continued with the sale of Annapurna to Amazon for $360 million in 2015 and the sale of Habana Labs to Intel for $2 billion in 2019.

"Within five minutes he already wrote down all the numbers: here is the value before money and this is the value after. Meanwhile we searched on Google what all these terms mean, it was too fast for us," said the three founders of Astera Labs when describing the first investment they received in 2017 from Avigdor Willenz, a serial entrepreneur who is responsible for a long series of impressive exits. Willenz is defined as a founding investor of Astera and is the Israeli connection to one of the hottest companies on the Nasdaq.

While everyone was engrossed in the publicized offerings of social networks Reddit and Donald Trump's Truth Social, the big story is, as usual, in the field of chips. Astera Labs, which develops chips to improve connectivity in data centers, is the real star of last week's IPOs, with a 150% jump since its IPO las Wednesday. This jump brought it during Tuesday's trading to a value of $13 billion, although it ultimately ended the day down over 5% after some investors chose to take profits. Not that Willenz particularly needs it, but the jump in Astera stock is definitely beneficial to his personal fortune.

Although Astera's IPO included the sale of $108 million-worth of shares of existing investors, Willenz did not appear among the known shareholders who sold and it is estimated that he owns several percent of the company. This exit joins Willenz's string of successes in the world of chips, which began with the sale of Galileo to American company Marvell for $2.7 billion in 2000 and continued with the sale of Annapurna to Amazon for $360 million in 2015 and the sale of Habana Labs to Intel for $2 billion in 2019.

Willenz does not hold any official managerial role at Astera Labs. The company has a small development and customer support center in Israel, which employs seven people out of a total of 267, the vast majority of whom are based in the U.S.

Astera was founded by three Texas Instruments veterans, who run the company from its headquarters in Santa Clara, California. What has ignited the imagination of investors in the past week is, unsurprisingly, Nvidia. The AI giant is a client of Astera, which also allowed it to present its products at the GTC conference held in San Jose last week.

The event was planned a long time ago, but came at an incredible timing for Astera. Intel and AMD are also the company's clients and, as befits the hot field, it made sure to include an almost infinite amount of the combination of the letters A and I throughout its IPO prospectus.

Astera's solutions are somewhat reminiscent of those of Eyal Waldman's Mellanox, which was sold to Nvidia for $6.9 billion in 2019. They are also designed to open bottlenecks in data centers and allow for a faster flow of data. Astera is the most surprising of last week's three IPOs, entering the market at the lowest value and with the least publicity. However, the way in which Astera, Reddit and Truth Social were all welcomed by Wall Street investors shows that they are once again hungry for new technology stocks.

The return of the famous pop - a sharp double-digit jump on the first day of trading - is an excellent sign. Truth Social, with its megalomaniac trading symbol "DJT" named after the former and possibly future president, also delivered the goods with a 50% jump at the opening of trading. Following the increase, the value of Trump's shares, who owns 60% of the social network, are already higher than $4 billion. This, even though its revenues amounted to only $3.5 million in the first three quarters of 2023.

The past week's IPOs signal that the IPO window on Wall Street has opened and are a positive sign for companies aiming for high valuation. According to estimates, the hottest companies in line are data management company Databricks and fintech company Stripe, which are aiming for a value of at least $50 billion, as well as Israeli company Navan (formerly TripActions), which is aiming for a valuation of $12 billion in its IPO prospectus. The cyber companies are also awaiting developments, a field that has warmed up again after being frozen since the last cyber IPO in September 2021. Cato Networks and Snyk are preparing for IPOs, as well as the American company Rubrik, and they are all aiming for a value of at least $5 billion.